The company saw several competitive products of premium EV sedans at the Shanghai Auto Show.

- China's NEV sales penetration rate rose to 11.4% in March.

- Nio's share in China's NEV market reached 3.4%.

- Notwithstanding, the Chinese premium EV market is entering a 'no apple to fall' situation.

- Nio is now building EV infrastructure with Sinopec.

- This collaboration could strengthen the company's advantages on infrastructure, costs and services, attracting more customers.

Amidst the coronavirus pandemic last year, the global economy was severely compromised. However, China's economic recovery is moving now at a lightning speed that overshadows other nations.

Passenger vehicle and EV sales locally carried the leading positions in March 2021, presenting surges of 80% and 352%, respectively.

In the same month, monthly EV sales first reached 11.3% of total car deliveries in the country. The rocketing EV sales mirror the overall strong consumption recovery.

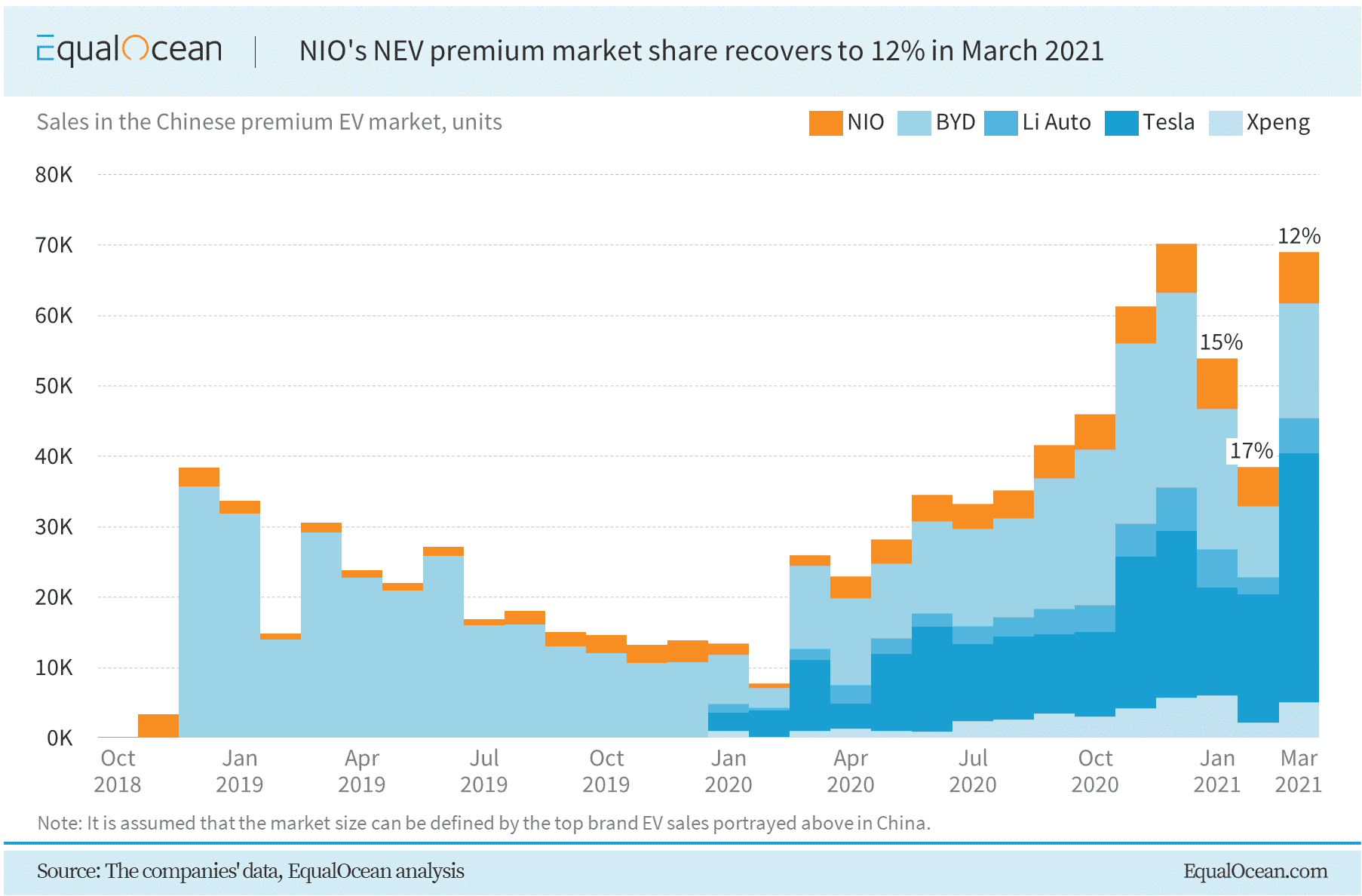

Nio broke its monthly record, delivering 7,257 vehicles in March. Meanwhile, Nio's EV market share was down to 3.4% mainly due to the booming sales of Wuling Mini, a product of SAIC Motor, Liuzhou Wuling Motors and General Motors' joint venture.

In 1Q, Nio delivered 20,060 units, meeting the sales expectation of between 20,000 and 20,500 vehicles.

On the other hand, the company's founder and CEO William Li claimed that due to the chip and battery shortage, the monthly production will remain at less than 7,500 units in the following months. He nevertheless believes that the supply chain issue will be eased in 3Q 2021.

Chinese EV market: no apple to fall

Notwithstanding Nio's strong delivery results, as mentioned in our last report, the EV market is expected to see more intense competition as different manufacturers are going to release new models in 2021.

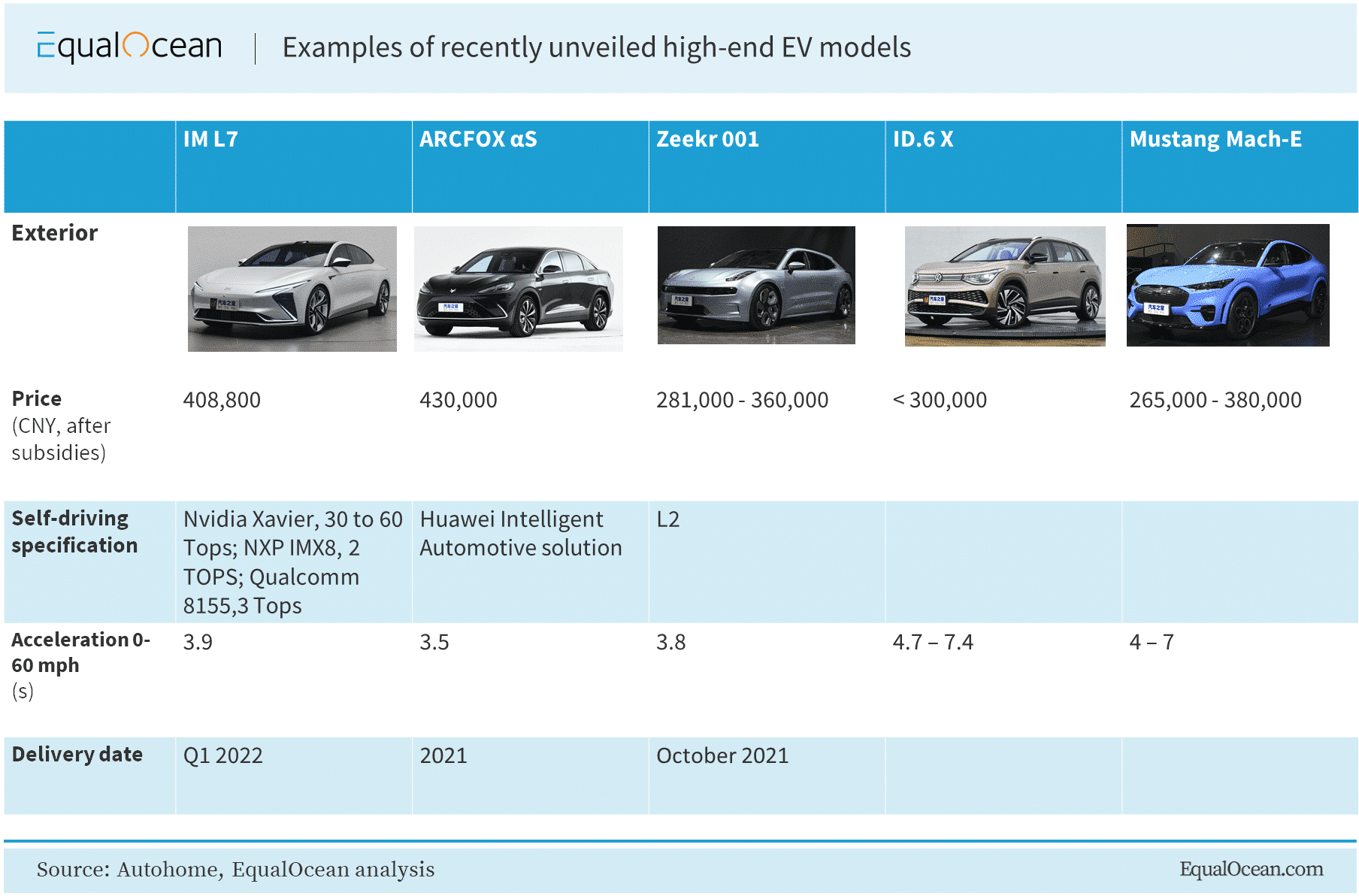

In April, a few brands launched similar products to Nio – and demonstrated them at the Shanghai International Automobile Industry Exhibition. It is not hard to tell that these brands are entering the premium EV market and eager to occupy a share. Below is a crop of the new vehicle models with competitive functions.

Other than the brands portrayed above, Baidu said that for every month in the rest of 2021, it is expected to have a new EV model equipped with self-driving solutions based on the Apollo platform.

Luckily for Nio, some of these models won't be sold within a year due to the production timeline and will not impact its sales too much in 2021.

Collaboration with Sinopec

Leaving aside market dynamics and competition, Nio's new form of cooperation with Sinopec is also worth mentioning. Even though some of the EV maker's previous strategic collaborations are not important, this new project definitely stands out.

On April 15, the founder William Li and other major management figures at Nio and Sinopec announced that they have released the second generation swap station in a Sinopec gas station in Beijing.

Based on their agreement, Nio will deploy many of its planned swap stations at Sinopec's sites. We think this initiative will create synergy effects for Nio in two ways.

- Siting: Most of Nio's current swap stations are geographically located in non-core urban areas, due to the difficulty in site selection (probably it's hard for Nio to find open-air places to build stations in the city center). By using Sinopec's sites, the construction of swap stations can solve the problem.

- Brand marketing: another significant benefit of building a swap station in Sinopec's gas station is to achieve accurate marketing. Hypothetically, every driver will be exposed to Nio's swap station when they are filling up their cars at some Sinopec's gas stations.

This is highly harmonic with Nio's broad strategy, whereby promotion is one of the important purposes of developing a swap station network.

Conclusion

With the economy bouncing back, China's automotive industry is recovering first, along with increased demand for both combustion engines and EV motors. The competitive landscape is becoming more intensified.

Nio, in turn, is actively reinforcing its business through infrastructure-related collaborations.

This article was first published by Niko Yang on EqualOcean, an investment research firm focusing on China.