If your industry is a mega-trend and you are the founder of the largest company in it, it's only natural to acquire a huge fortune.

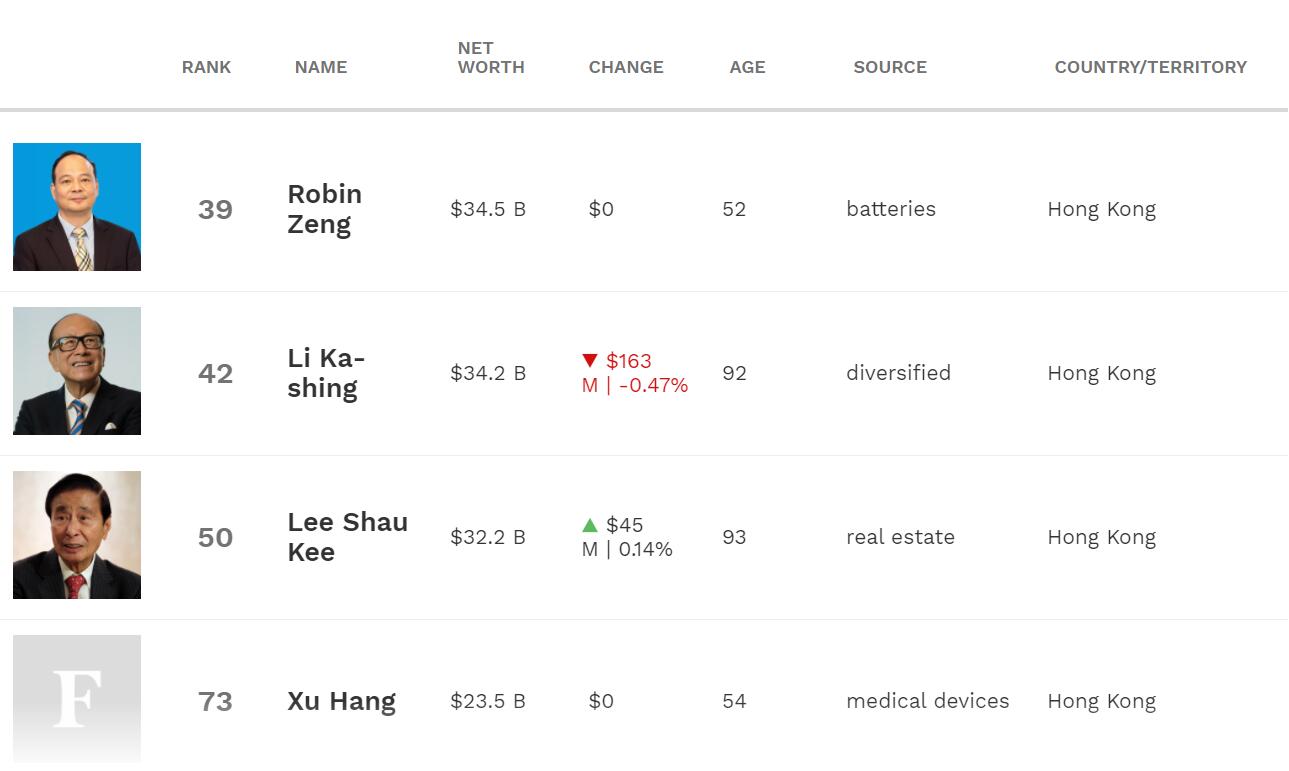

Forbes' real-time billionaires' rankings show that Robin Zeng, founder of Nio and Tesla's battery supplier Contemporary Amperex Technology (CATL) has now surpassed Li Ka-shing as the new richest person in Hong Kong.

As of Wednesday, Zeng's real-time personal wealth reached $34.5 billion, ranking him 39th in Forbes' real-time billionaires' rankings. By comparison, Li's real-time personal wealth was $34.2 billion, ranking 42nd.

Nio's supplier

Zeng's soaring fortune is related to the surge in demand for power batteries due to the electrification of automobiles.

CATL has topped the global power battery shipments for four consecutive years, with customers including Nio, Tesla, Xpeng Motors, Li Auto, BMW, Mercedes-Benz, Volkswagen, and Volvo.

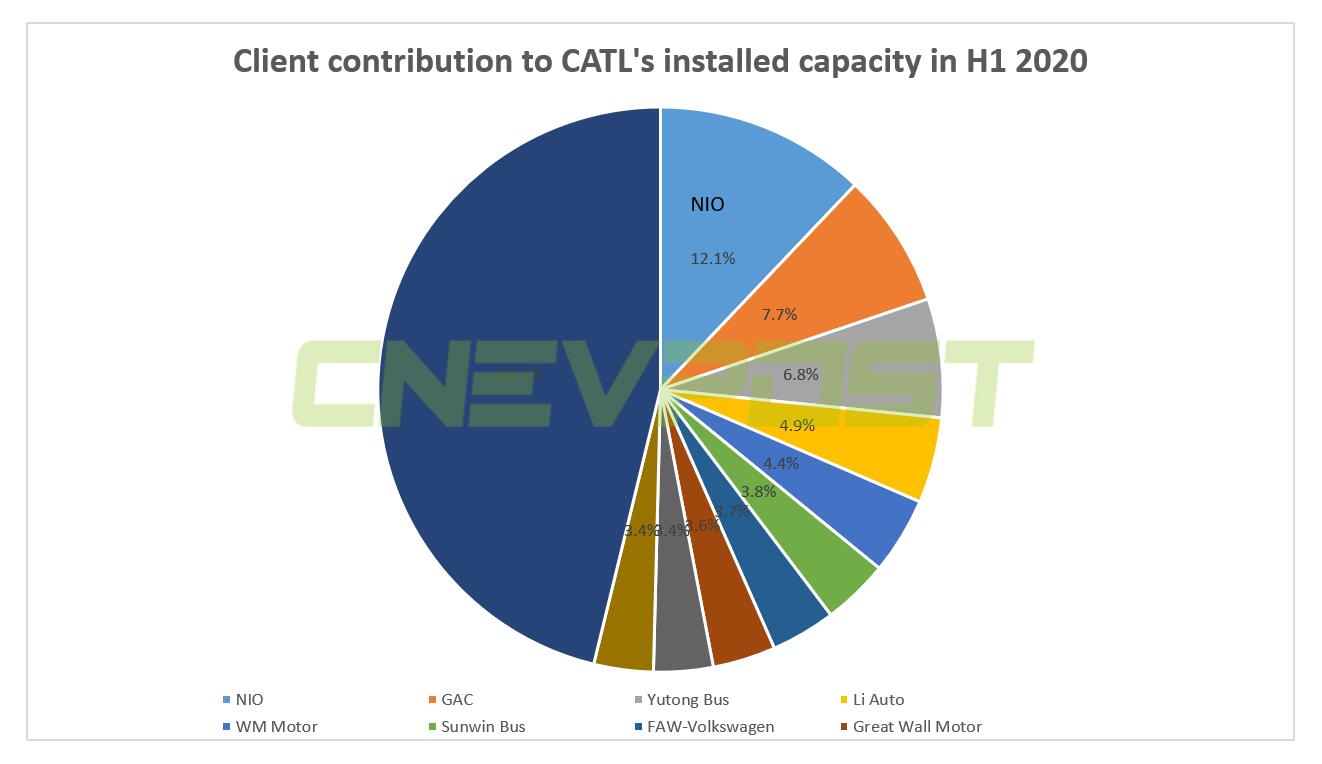

In the first half of 2020, Nio became CATL's largest customer as its shipments continued to rise.

CATL's power battery installed capacity in China was 8.4GWh in the first half of last year, with a 50% market share. Nio contributed 12.1% of the volume at the time, making it its largest customer, according to power battery industry researcher GGII.

(Data source from GGII. Graphic by CnEVPost.)

Late last year, CATL began supplying lithium iron phosphate batteries to Tesla for use in the latter's entry-level model currently priced at RMB 249,900 yuan ($38,600) in China.

In August last year, CATL invested with Nio, Guotai Junan International and Hubei Science and Technology Investment Group to establish Wuhan Weineng Battery Assets Co to promote the development of the new business model of "body and battery separation".

It is worth noting that this model is the label of Nio, whose signature BaaS (Battery as a Service) business is operated by Weineng.

Soaring stock price

CATL shares have soared more than 150% in the past year as the electric vehicle industry has grown rapidly.

The largest Chinese power battery maker's shares are now up 230% from early 2020, with a recent market capitalization of RMB 904.2 billion.

Zeng's personal wealth of $34.5 billion has more than tripled from $9.7 billion when Covid-19 hit the market hard last March.

CATL shares rose to an all-time high of RMB 424.99 on Jan. 8, 2021, with a total market capitalization of RMB 989.8 billion at that time.

In the past month, CATL's share price has risen 21.16% from its recent bottom.

CATL is headquartered in Ningde, Fujian province, and its founder, Zeng, is a local native, except now he has a permanent residence permit in Hong Kong.

Born in 1968, Zeng joined a Chinese state-owned enterprise after graduating from Shanghai Jiaotong University, but chose to quit after three months to work to join the manufacturing boom of Guangdong.

During his career, Zeng traveled to the United States to study battery technology before co-founding Amperex Technology Limited (ATL), a producer of lithium-ion batteries.

After ATL's investors sold their stake to Japan's TDK Group, Zeng established CATL to focus on the power battery business.

CATL's Chinese name sounds like "your time," suggesting that the company is aiming to be ahead of the industry trend.

The company's earnings report showed that it achieved revenue of RMB 19.17 billion in the first quarter, up 112.24 percent year-on-year. Net profit attributable to shareholders of the listed company reached RMB 1.95 billion, an increase of 163.38% year-on-year.