Deutsche Bank analysts reduced their price target on Chinese electric vehicle maker Xpeng Motors by $7 to $48, mostly to account for downward re-rating in the peer group.

Analysts led by Edison Yu now use an 8x multiple on 2022E EV/Sales compared with the prior 9x, they said in a note to investors on Tuesday.

The team trimmed their 2021 delivery forecasts for Xpeng, now expecting 65,000 vehicle deliveries, down about 5,000 from the prior forecast.

While in the long term, the team is still bullish on the stock, saying:

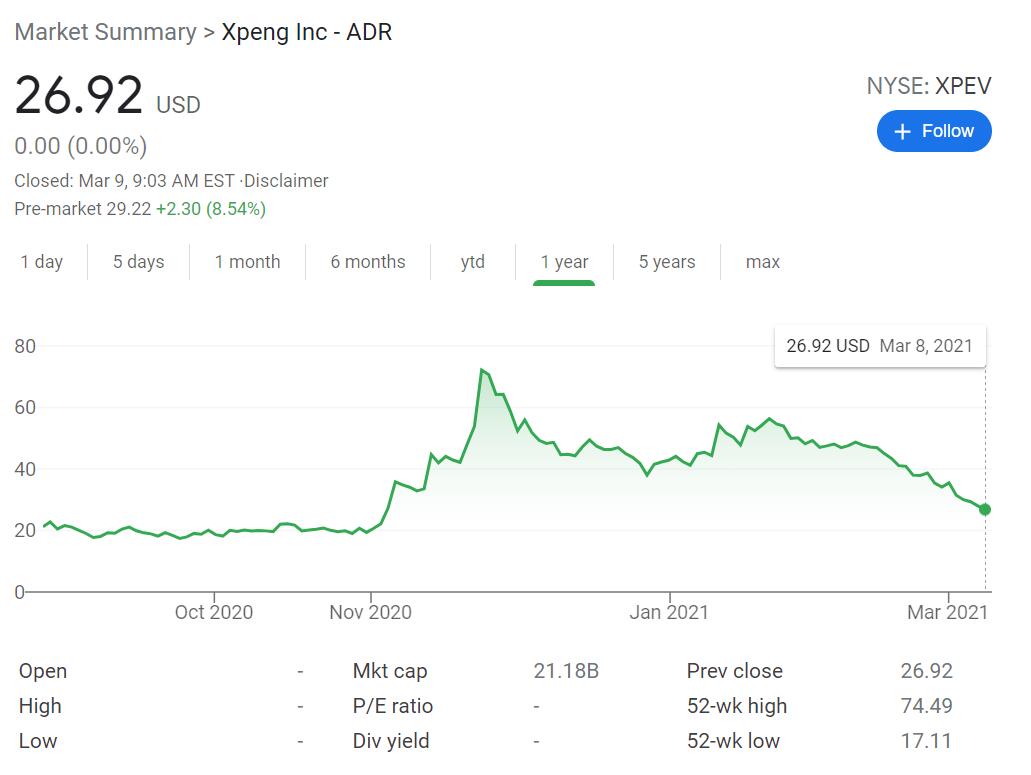

Xpeng stock continues to be under pressure despite mostly solid earnings and a de-risked guide as investors sour on EV valuations (e.g., Tesla+Nio have lost > $300bn of market cap in the past month).

While it will be difficult to anticipate when sentiment can recover, we do believe unlike in past investment cycles, this transition to an electrified world is accelerating and being aggressively pushed by not only governments but also consumers.

We continue to see Xpeng emerging as a winner in this new world order and while concerns have arisen about near-term demand (soft Feb deliveries) and broader competition (tech and legacy), we think these will be addressed as monthly volumes improve materially over the course of the year and Xpeng demonstrates its latest XPILOT capability (7-day journey across China using NGP and memory park demo).

Xpeng shares rose nearly 9 percent in the pre-market after a severe sell-off on Monday. The stock is down 52 percent since Jan. 25.

Here is Yu team's main arguments:

Volumes should improve as year progresses

Management provided guidance for 1Q21 calling for 12,500 deliveries (+450% YoY, -4% QoQ), below our ingoing 13,500 forecast, mainly due to weaker than anticipated February volume which was already reported last week (delivered just r2,223 units, taking Jan-Feb to 8,238).

This implies March coming in around 4,262 units. We trim our estimates down to 12,750 deliveries and 2.8bn revenue (slightly above 2.6bn guidance).

Beyond 1Q, Xpeng expects 2Q deliveries to increase sequentially and then volumes to improve further in 2H driven by a mid-cycle G3 refresh and deliveries of 3rd model in 4Q (smaller sedan, to be unveiled in 2Q). Management indicated early orders for the LFP versions of the P7 and G3 are robust with 20% of P7 mix now comprised of LFP version (10% for G3).

More broadly, Xpeng does not expect the semis shortage to be a constraint on production at the moment and is also comfortable with LFP battery cell capacity as CATL is providing a new line, incremental to the existing two lines.

For the full-year, management did not provide much guidance but indicated opex should be up substantially as R&D and SG&A both ramp up meaningfully from 2020 levels as Xpeng accelerates vehicle development, continues building up ADAS/AD engineering capabilities (double R&D headcount), and expand sales/charging footprint (e.g., from 159 fast charging stations to >500 by year-end).

Factoring in the updated outlook, we adjust our 2021E forecasts, now expecting 65k deliveries, down ~5k from prior forecast (see Figure 1). Our gross margin forecast remains largely unchanged at <13% with 1Q garnering strong benefit from revenue recognition related to XPILOT 3.0. Our opex increasers significantly which drags our EPS down for 2021-22E.

XPILOT roadmap on track

In our view, XPILOT continues to be a key differentiator for Xpeng. The roll-out for NGP (navigation guided pilot) over the past few months has largely been a success with over 1 million kilometers driven by users in the month of February.

In addition, the company indicated >20% of the existing P7 fleet have activated XPILOT 3.0, suggesting >4.1k users and the take-rate has been increasing since NGP was officially launched intra-quarter.

Xpeng's third model will have LiDAR as an option rand run XPILOT 3.5, enabling greater degree of road coverage and reliability; XPILOT 4.0 will have city driving L4 features. XPILOT 4.0 was slated to come out in r2023 but management seems to be tracking ahead of that.

We continue to believe than the company will shift to a subscription model with XPILOT 4.0 and charge more for version 3.5 HW+SW (potentially 10-20k RMB more given inclusion of 2 LiDAR sensors), ultimately discontinuing the entry level offerings to drive up software attach rate.

Sell-off overdone but acknowledge broader EV re-rating

We reduce our price target by $7 to $48, now using an 8x multiple on 2022E EV/Sales (vs. prior 9x), reflecting slightly lower estimates but mostly to account for a broader re-rating in EV assets. Xpeng's stock has declined 43% over the past month r(vs. NASDAQ -10% and KWEB -18%). We attribute this to the following factors:

Rising concerns about competition both in the near-term (following softer than expected February monthly sales) and longer term (tech entrants such as Baidu, Apple, Foxconn, Xiaomi, etc...).

Overabundance of EV related investment choices especially via SPACs flooding market Growing belief that current XPILOT software advantage in ADAS/AD could be eroded Broader re-rating for EV assets (e.g, Tesla -35% over the past month).

We don't think the lock-up was an overly large factor of the sell-off considering Nio has also dropped >40% in the same period of time and did not have to face a lock-up expiring.

Looking ahead, we continue to see Xpeng emerging as a winner in the new EV world order and believe some of the aforementioned concerns (mainly first 3) will be addressed as monthly volumes improve over the course of the year and Xpeng demonstrates its latest XPILOT capability (7-day journey across China using NGP rand memory park demo).