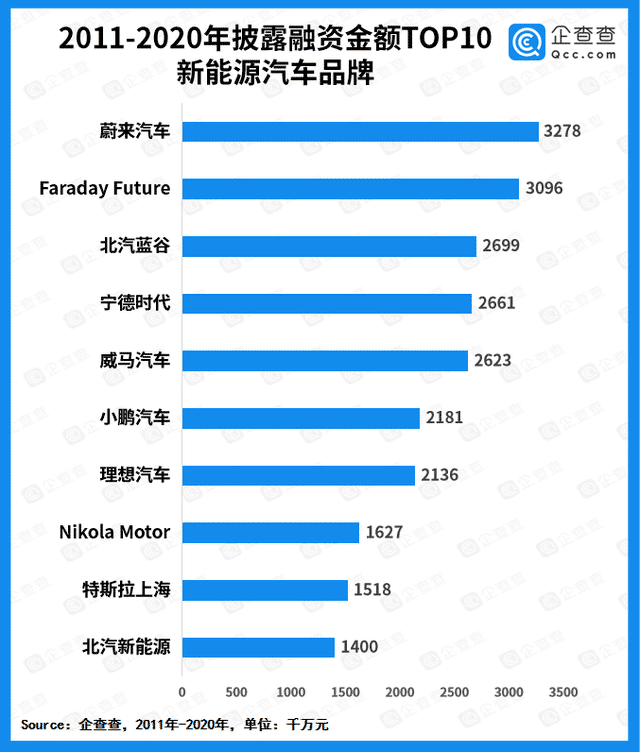

US-based EV maker Faraday Future (FF) has raised a total of 8 public financing rounds since its inception, totaling 30.96 billion yuan ($4.8 billion), second only to its Chinese peer Nio, according to data provider Qichacha.

FF is an electric car company founded by Jia Yueting, an entrepreneur who in October 2019 filed for bankruptcy in the US after running up billions of dollars in personal debt.

US investors have participated in four rounds, while its Chinese investors include LeEco, Evergrande Group, and The9 Limited, and another one is Tata Motors, a giant Indian conglomerate.

According to earlier reports, Zhuhai's state-owned capital recently invested 2 billion yuan in the company. Geely Electric Appliances, Gree Groups, and Huafa Group also reportedly participated in the investment in it.

FF and special purpose acquisition company (SPAC) Property Solutions Acquisition Corp. (PSAC) today announced a definitive agreement to merge their businesses, with the combined entity to be listed on Nasdaq under the symbol "FFIE".

The merger transaction provides FF with approximately $1 billion in capital, including $230 million in cash held in trust by PSAC and oversubscription of $775 million in common stock at a price of $10.00 per share, providing sufficient capital to support the mass production and delivery of FF's flagship product, the FF 91.

At a subscription price of $10.00 per PIPE share, the transaction indicates an implied equity value of $3.4 billion for the combined company.

Nio raised more than RMB 32.8 billion ($5 billion) in cumulative funding in 2020. In April 2020, Nio raised RMB 7 billion with investors from Anhui Province.

In June 2020, Nio received $492 million in funding through the issuance of 72 million additional ADSs.

In July 2020, Nio received a total of RMB 10.4 billion in bank credit from several Chinese banks.

In August 2020, Nio received $1.73 billion in funding through the issuance of 88.5 million additional ADSs.