In the fourth week of April (April 20-25), China's passenger car market daily average retail sales reached 48,700 units, up 12% year-on-year, data from the China Passenger Car Association (CPCA) showed.

In the first four weeks this month, the year-on-year retail growth rate picked up to -2%, April's full month-on-month retail growth is expected to reach -6%, which is very good performance of the market recovery, CPCA said.

Taking into account the new coronavirus epidemic before the January retail growth rate of -20%, February growth rate of -80%, March growth rate of -40%, the April retail should reflect the Chinese car market's V-shaped reversal of the trend has been basically determined, the CPCA report said.

The V-shaped reversal in April was mainly due to the rapid recovery of production and sales, and under the strong impetus of the resumption of national production and work, the main enterprises outside the core of the epidemic have basically resumed work in early March.

The following is a translation of the full report

Passenger car market retail trend picks up steadily in April

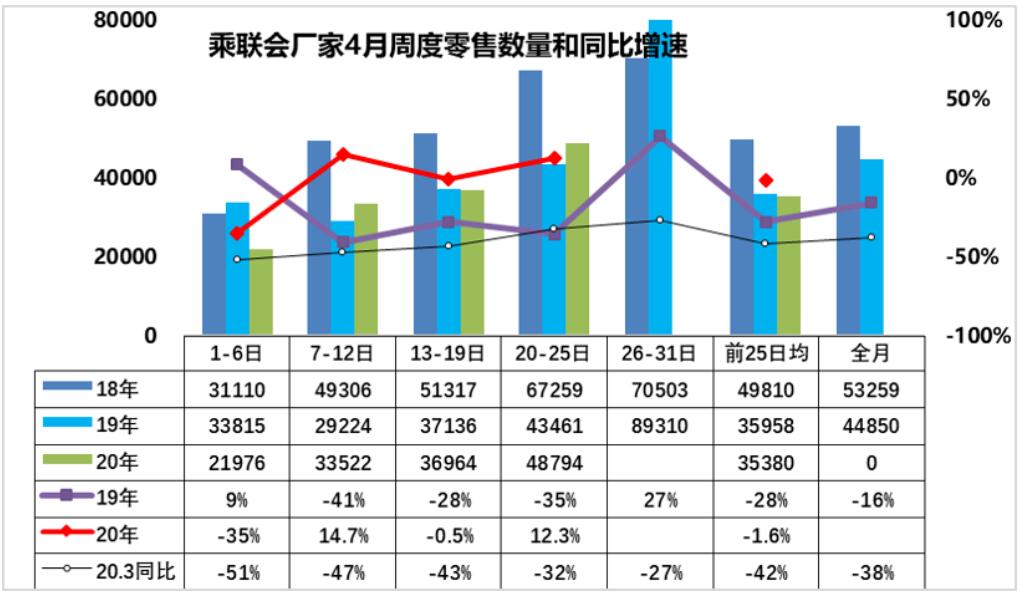

The passenger car market retail performance in the first week of April (1-6) was weak, with daily retail sales averaging 21,900 units in the first week, a 35% decline in year-on-year growth.

The passenger car market retail rebounded relatively strongly in the second week of April (7-12). Both second Sundays retailed 33,500 units, up 14% year-on-year. Overall sales recovered significantly in the second week. Sales generally recovered faster in the second week, but it is not advisable to be too optimistic.

The first week's sales were affected by the Qingming holiday on 5-7 in the same period, last year there were four working days in the first week and this year there were three working days in the first week of April, so the first week's growth was poor and the second week was good, making some difference.

The retail rebound in the passenger car market in the third week of April (13-19) was relatively flat. Average daily retail sales in the third week were 3.69 million units, down slightly by 0.5% year-on-year.

The third week's overall sales recovered steadily, and some Hubei car factories resumed production quickly, which contributed more to the increase in car market sales.

The retail rebound in the passenger car market in the fourth week of April (20-25) was relatively flat. Fourth Sunday retailed an average of 48,700 units, up 12 percent year-on-year.

The overall retail rebound in the passenger car market was relatively quick in the one to four weeks of April (1-25).

The first four weeks of daily average retail sales of 35,300 vehicles, a year-on-year growth rate of 1.6 percent, the April warming is obvious, compared with the first four weeks of March, a year-on-year decline of 42 percent growth rate improved greatly.

April market rebound reflects the car market retail has been smoothly improved from the impact of the epidemic.

From the recovery progress, the phenomenon of demand outbreak growth is gradually reflected, if ironing out the first and second week of growth, the current week by week rapid rise in sales performance year-on-year is still relatively strong.

Although the government intends to introduce the car market stimulus policy, some city policies actually take effect, but the effect of the policy launch period is generally not very prominent and wait until the policy exit before the last train effect is obvious.

As the epidemic spreads and becomes more chronic abroad, the demand for private cars has become more rigid as consumers respond to the normalization of the epidemic, and the demand for cars is relatively good in the near future.

Wholesale passenger car market gradually strengthened this month

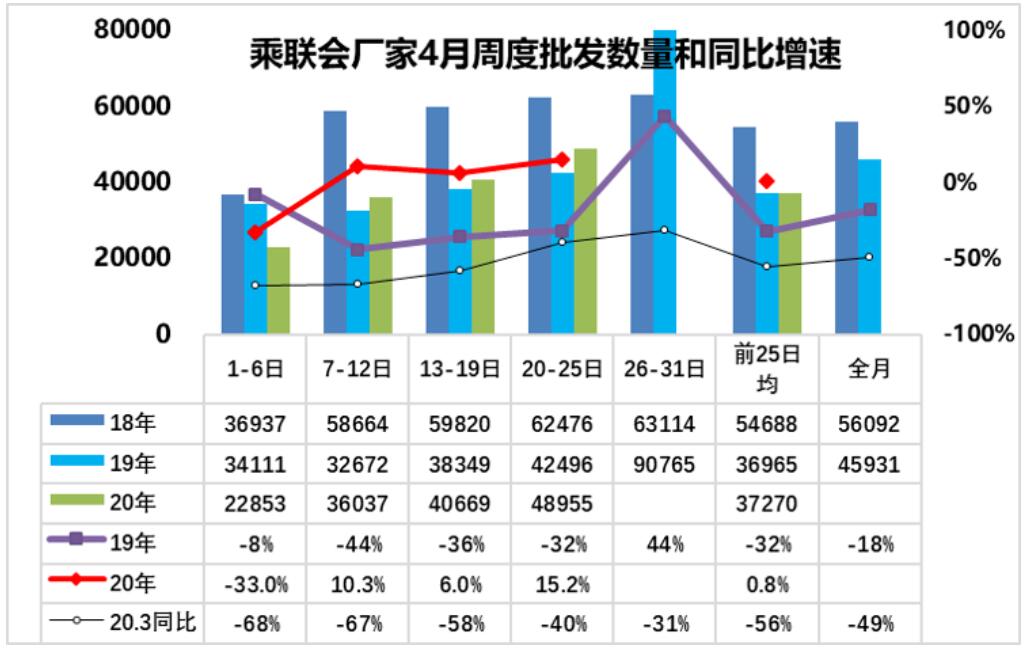

In the first week of April (1-6), passenger car dealers rebounded strong performance, the first week of daily average factory sales of 28,000 vehicles, a year-on-year growth rate of 33% decline. The overall recovery in factory sales was noticeable in the first week.

Average daily factory sales of 3.6 million units in the second week of April (7-12) were up 10 percent year-on-year, a larger improvement from the 33 percent drop in the first week.

Average daily factory sales of 4.06 million units in the third week of April (13-19) rose 6% year-on-year, a slight slowdown from the 10% increase in the second week.

The fourth week of April (20-25) daily average factory sales of 48,900 vehicles, up 15% year-on-year, compared with the third week of the year-on-year growth rate of 6% has been improved, but also a clear sign of supply improvement, a good boost to the industry development.

Wholesale in the first four weeks of April reached a daily average of 37.2 thousand units, a year-on-year growth rate of 0.8% relative to the previous month's growth rate of 56% decline in a stronger performance.

As April manufacturers fully resume the assessment and incentives, so the frequency of dealership purchases relatively gradually return to normal. April’s first to fourth weeks of wholesale reached an average of 37,200 units per day, but the retail reached 35,300 units, wholesale and retail trends back to the normal situation of wholesale than retail, which is a very good thing.

The recent retail recovery is slightly better than expected, relative to the gradual recovery of retail inventories in the current period, the inventory shortage problem is doubly highlighted, dealers return to the normal promotional mode will also pull sales to improve.

V-shaped reversal in China's auto market after epidemic

The year-over-year retail sales growth rebounded to -2% in the first four weeks of April and is now judged to be -6% year-over-year for the full month of April, which is a good indication of a market rebound.

Taking into account the pre-infection retail sales growth rate of -20% in January, -80% in February and -40% in March, the retail sales in April should reflect the V-shaped reversal of the Chinese car market has been basically determined.

The main reason for the V-shaped reversal in April is the fast recovery of production and sales, driven by the strong resumption of production and work in the country, the main enterprises outside the epidemic core area have basically resumed work in early March, and the rapid resumption of work in Hubei at the end of March, which has a good effect on the recovery of production and supply in April to keep up with the retail beat.

Secondly, the retail recovery is relatively good, under the worry of the long tail effect of the epidemic, as more people after the epidemic to travel safety considerations, rigid car purchase demand gradually outbreak.

(c) The third is the accelerated release of demand for vehicle replacement as some of the trade-in demand groups have become more concerned about the quality of travel after the epidemic.

The fourth is the introduction of national and some local policies to promote consumption, which has promoted the release of the demand for car purchase from the consumer groups in the early stage.

A variety of factors pulled the car market's continued strength in April.

Supply chain security for the long tail effects of the epidemic

At present, the epidemic protection in Europe and the United States has achieved some effect, but the continued impact is difficult to eliminate in the short term, the need to establish supply chain risk warning, collaborative manufacturing, production capacity sharing, flexible conversion of production and other systems of protection.

The automotive manufacturing industry is the "integrated" industry of long industry chain, large synergy, large manufacturing, the establishment of efficient synergy, competitive advantage of the supplier system, and the consolidation of a complete and powerful automotive supply chain is an important support for the automotive industry.

Competition among automotive OEMs is essentially a competition between system capabilities and supply chains. At present, the automotive industry in Europe and the United States and Southeast Asia and other countries are facing a sustained impact, the current face of the risks of the international supply chain, should be localized supply chain support measures, while increasing the reserve capacity of the international core supply resources.

The HW2.5 autopilot chip costs more and performs worse than the more powerful HW3.0, but the HW3.0 chip is out of supply, leading consumers to defend their rights.

This is a warning to domestic car companies to strengthen safety reserves, and to stabilize the market environment to ensure supply chain stability and reasonable expectations. This new energy vehicle subsidy policy of three years of relative stability, the product layout of car enterprises and model renewal iterations are very good things.

Auto market retaliatory demand outbursts won't be too strong looking at household assets and liabilities

In October 2019, the Assets and Liabilities Survey of Urban Residents' Households, Department of Survey and Statistics, People's Bank of China, conducted a survey on the assets and liabilities of more than 30,000 urban resident households. This is one of the most complete and detailed surveys of urban residents' assets and liabilities in the country.

According to the survey, firstly, urban households have an average total household asset of 3,179,000 yuan, with a markedly differentiated asset distribution; secondly, urban households have a high debt participation rate of 56.5 per cent. Mortgages are the main component of household debt, accounting for 75.9 per cent of total household debt.

Core issues: some low-asset households are insolvent and have a high risk of default; middle-aged and young people are under high debt pressure and have a higher risk of debt; older people invest more in financial products such as bank finance, asset management and trusts and have a higher risk of debt; households with just-required housing loans have a prominent risk of debt.

Car market correlation effect: high demand for luxury cars from high-net-worth households. The relatively high pressure on young people's exquisite living debt, compounded by the debt burden of home ownership, has led to a significant decline in young people's ability to buy cars.

This trend has been particularly pronounced in recent years as house prices have risen, which poses continuing concerns for the car market for some time to come.

30,000-yuan subsidy threshold is reasonable

Notice on improving the promotion and application of new energy vehicles financial subsidy policy, clearly stipulates that the new energy passenger car subsidy before the sale price must be less than 300,000 yuan (including 300,000 yuan). This should be good oriented policy.

The first is to improve the efficiency of subsidies by subsidizing mainstream products and reducing subsidies for luxury high premium products.

At the same time, it is conducive to new energy vehicles to improve the price competitiveness of products, and to achieve convergence with the traditional car price system. Ultimately, the speed of replacement of conventional fuel vehicles by new energy vehicles will be increased and the penetration of new energy vehicles will be increased.

In order to support the high-quality development of the new energy automobile industry, do a good job in the promotion and application of new energy vehicles, promote the consumption of new energy vehicles, drawing on the practices of the United States, Germany, the United Kingdom, France and other countries, in order to avoid a large flow of subsidies to luxury consumption, taking into account the level of purchasing power of Chinese consumers, industry development and other factors, the policy requires the new energy passenger car subsidies before the selling price of 300,000 yuan or less.

New energy passenger car subsidies before the price needs to be less than 300,000 yuan, which is a good forward-looking policy, for the development of new energy vehicles has a good effect on the promotion of new energy vehicles, 2 million units of subsidies ceiling can be greater support for mainstream products.