Xpeng expects first quarter vehicle deliveries to be in the range of 18,000 to 19,000 units, implying that March deliveries are expected to be 6,772 to 7,772 units.

Xpeng (NYSE: XPEV) posted weaker-than-expected fourth-quarter revenue, with its gross margin falling to single digit due to increased promotional activities.

Xpeng reported revenue of RMB 5.14 billion ($750 million) in the fourth quarter, higher than the upper end of its previous guidance range but missing market expectations of RMB 5.732 billion, according to the company's unaudited fourth-quarter financial results released today.

That was a 39.9 percent year-on-year decline and a 24.7 percent drop from the third quarter. The company's previous revenue guidance for the fourth quarter was RMB 4.8 billion to RMB 5.1 billion.

Xpeng reported fourth-quarter vehicle sales revenue of RMB 4.66 billion, down 43.1 percent from the same period in 2021 and down 25.3 percent from the third quarter.

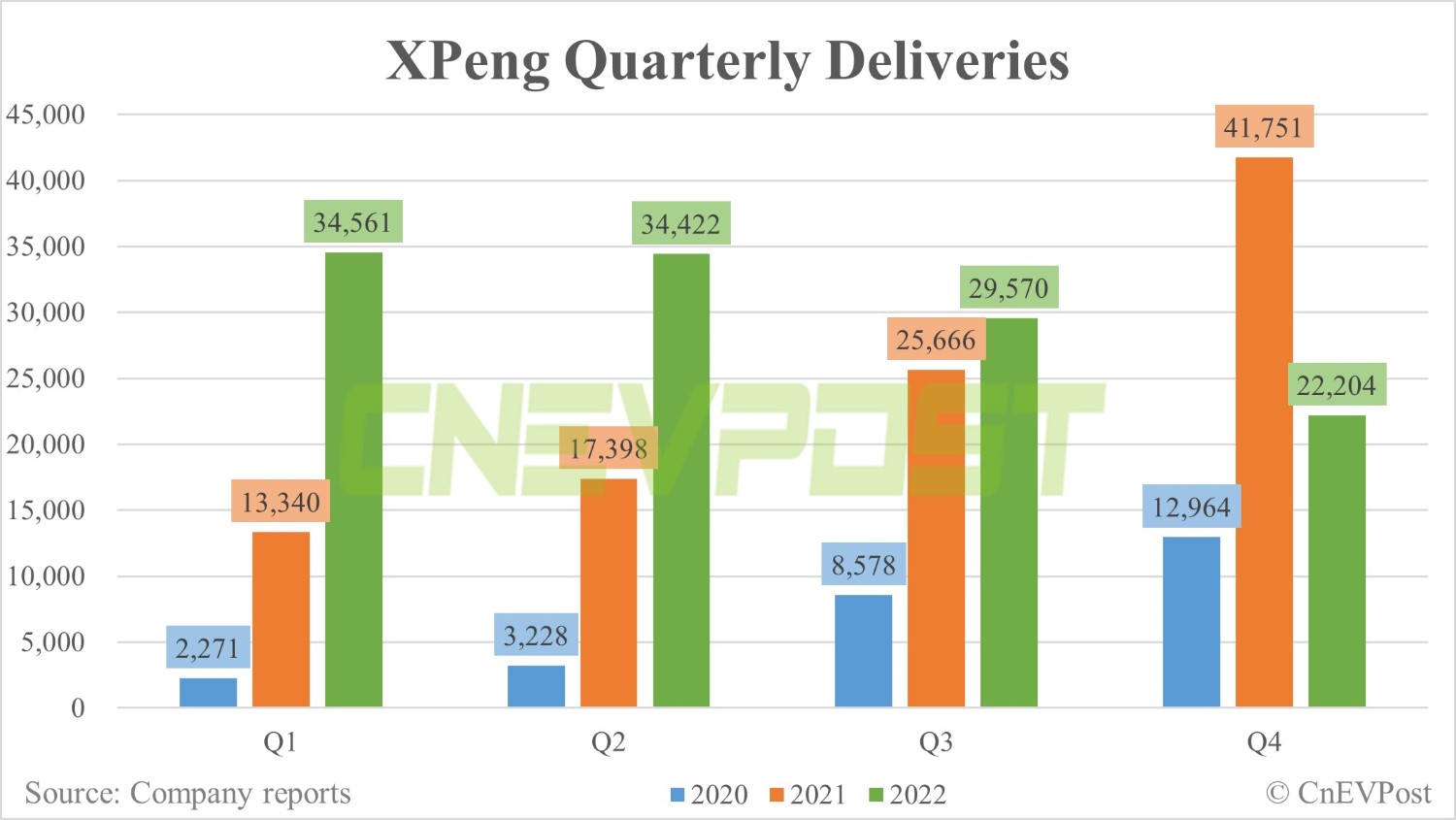

It delivered 22,204 vehicles in the fourth quarter, above the upper end of the previously provided guidance range of 20,000 to 21,000, but down 46.82 percent year-on-year and down 24.91 percent from the third quarter.

The company's gross margin was 8.7 percent in the fourth quarter, down from 12.0 percent in the same period in 2021 and down from 13.5 percent in the third quarter.

It was the lowest point for Xpeng's gross margin since the fourth quarter of 2020, and the company said the decline was due to increased promotional activities.

It reported a vehicle margin of 5.7 percent in the fourth quarter, down from 10.9 percent in the same period in 2021 and down from 11.6 percent in the third quarter.

Xpeng reported a net loss of RMB 2.36 billion in the fourth quarter, higher than annalysts' expectation of a loss of RMB 2.076 billion and higher than the loss of RMB 1.29 billion in the same period last year.

It reported a basic and diluted net loss of RMB 2.74 per American Depositary Share (ADS) and a basic and diluted net loss of RMB 1.37 per ordinary share in the fourth quarter. Each ADS represents two Class A ordinary shares.

On a non-GAAP basis, it reported a basic and diluted net loss of RMB 2.57 per ADS and a basic and diluted net loss of RMB 1.29 per common share for the fourth quarter.

Xpeng's R&D expenses for the fourth quarter were RMB 1.23 billion, a 15.3 percent decrease from RMB 1.45 billion in the same period in 2021 and a 17.9 percent decrease from RMB 1.50 billion in the third quarter. These decreases were mainly in line with the timing and progress of the new vehicle programs, it said.

It reported selling, general and administrative expenses of RMB 1.76 billion in the fourth quarter, down 12.9 percent from RMB2.02 billion in the same period in 2021 and up 8.0 percent from RMB 1.63 billion in the third quarter.

The year-on-year decrease was primarily due to lower commissions from franchised stores related to lower vehicle deliveries. The quarter-over-quarter increase was primarily due to higher marketing, promotional and advertising expenses to support vehicle sales, it said.

Xpeng expects first quarter vehicle deliveries to range from 18,000 to 19,000 units, a decrease of about 45.0 percent to 47.9 percent year on year.

Considering the company delivered 5,218 vehicles in January and 6,010 vehicles in February, the guidance implies that March deliveries are expected to be between 6,772 and 7,772 vehicles.

The company expects total revenue for the first quarter to be in the range of RMB 4.0 billion to RMB 4.2 billion, a decrease of about 43.7 percent to 46.3 percent year-on-year.

Xpeng cash and cash equivalents, restricted cash, short-term investments and time deposits amounted to RMB 38.25 billion as of December 31, 2022.

XPeng earnings preview: Q4 to be soft with promotions hitting margins