The move comes after Mirattery secured tens of millions of dollars in financing through an ABN offering in April, marking the establishment of its direct access to financing in the exchange and interbank markets.

Nio's battery asset management joint venture, Wuhan Weineng, or Mirattery, has secured new financing through an ABS (Asset-backed securities) offering, after raising tens of millions of dollars through a similar move in late April.

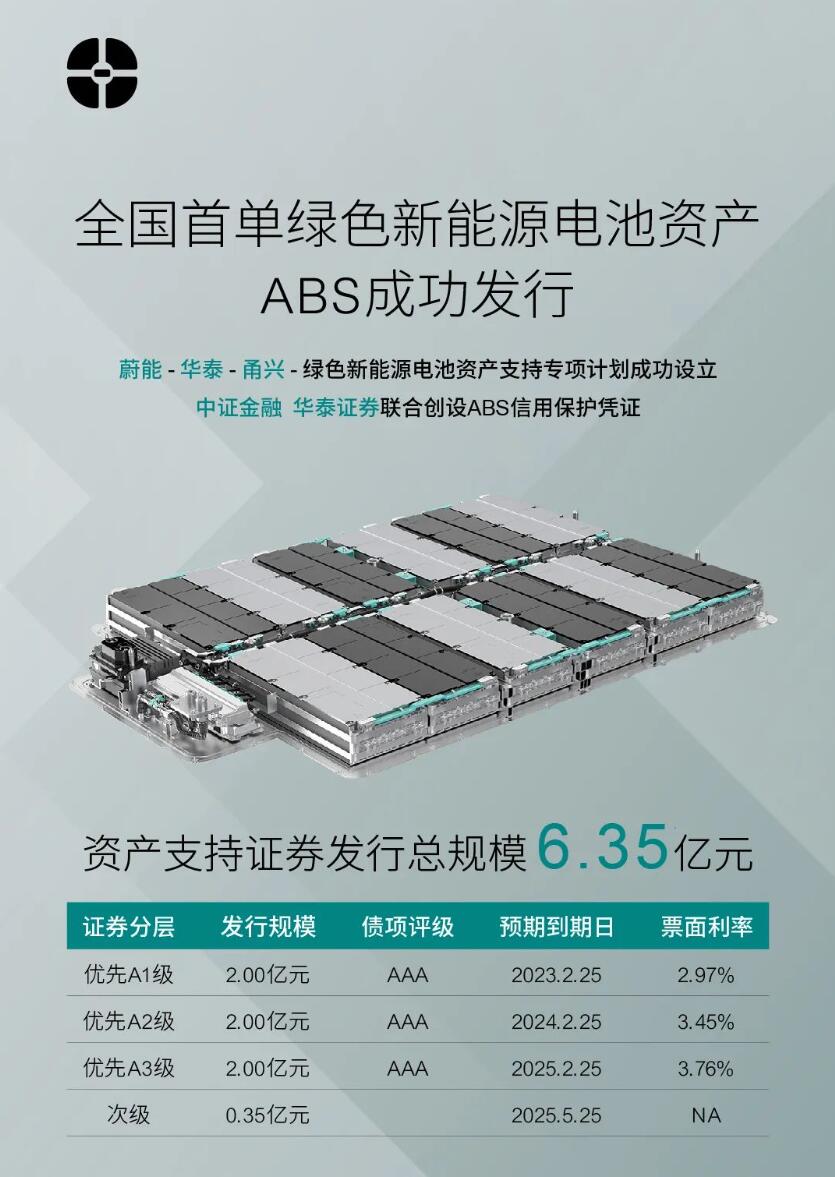

Mirattery successfully issued the ABS on the Shanghai Stock Exchange today for a total size of RMB 635 million ($95 million), according to a press release issued by the company.

The ABS are divided into senior A1, senior A2, senior A3 and subordinated, with each of the three senior tranches having an amount of RMB 200 million and the subordinated tranche having an amount of RMB 35 million.

These assets mature as early as February 25, 2023 and as late as May 25, 2025, with interest rates ranging from 2.97 percent to 3.76 percent.

For ABS issuers, lower interest rates mean lower costs. For reference, China's central bank lowered the benchmark 5-year LPR (loan prime rate) by 15 basis points to 4.45 percent on May 20 and left the 1-year LPR unchanged at 3.7 percent.

The ABS issuance is another attempt by Mirattery to raise capital markets funding, following an ABN issuance on April 19, the company said.

This marks the completion of Mirattery's establishment of direct financing channels in the exchange and interbank markets, and provides a further safeguard for the company's BaaS (battery as a service) service system, it said.

The successful issuance of the ABS reflects the Chinese capital market's recognition of Mirattery's BaaS model and asset management capabilities, which further broadens the company's low-cost financing channels, it said.

On April 19, Mirattery successfully issued RMB 400 million ($62.62 million) in ABNs (Asset Backed Medium-term Notes) in China's interbank market.

Mirattery was established on August 18, 2020 with a registered capital of RMB 800 million by CATL, Nio (NYSE: NIO, HKG: 9866, SGX: Nio), Guotai Junan and Hubei Science Technology Investment.

In August 2020, Nio launched its BaaS battery leasing business and Mirattery is the manager of the battery assets.

The BaaS business allows users to purchase a Nio vehicle without buying a battery, thereby reducing the cost of the vehicle at the time of purchase by at least RMB 70,000. But instead of the owner owning the battery, Mirattery will hold the title to the battery.

In an April 19 press release announcing the ABN offering, Mirattery said it had more than 6 GWh of battery assets under management, and it did not mention the latest information on battery assets under management in today's press release.